Sectors of Economic Activities

Sector defines a large segment of the economy in which businesses share the same or a related product or service.

- When we produce a good by extraction and collection of natural resources, it is known as the primary sector. Eg: Farming, forestry, hunting, fishing and mining.

- The secondary sector covers activities in which natural products are changed into other forms through ways of manufacturing. It is the next step after primary. Some manufacturing processes are required here. It is also called the industrial sector. For example, using cotton fibre from the plant, we spin yarn and weave cloth. Using sugarcane as raw material, we make sugar or gur.

- Tertiary sector includes activities that help in the development of the primary and secondary sectors. These activities, by themselves, do not produce a good but they are an aid or support for the production process. It is also called the service sector. Example: Teachers, doctors, washermen, barbers, cobblers, lawyers, call centres, software companies, etc.

Comparing the 3 Sectors

The value of final goods and services produced in each sector during a particular year provides the total production of the sector for that year. The sum of production in the three sectors gives Gross Domestic Product (GDP) of a country. GDP is the value of all final goods and services produced within a country during a particular year. It shows how big the economy is. In India, the task of measuring GDP is undertaken by a central government ministry.

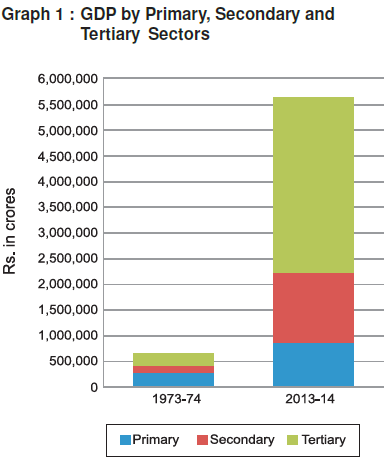

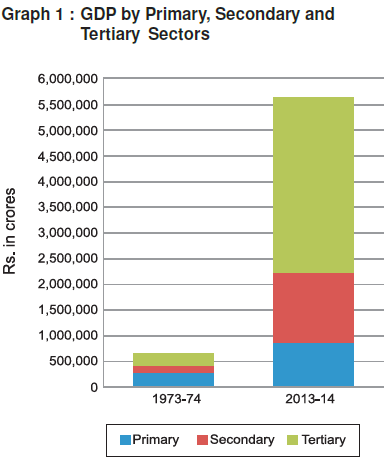

The graph below shows the production of goods and services in the three sectors.

In the year 2013-14, the tertiary sector emerged as the largest producing sector in India, replacing the primary sector. The tertiary sector has become important in India because of the following reasons:

- Services such as hospitals, educational institutions, post and telegraph services, police stations, courts, village administrative offices, municipal corporations, defence, transport, banks, insurance companies, etc. are considered as basic services and are necessary for all people.

- The development of agriculture and industry leads to the development of services such as transport, trade, storage, etc.

- With the rise in the income of people, they start demanding more services like eating out, tourism, shopping, private hospitals, private schools, professional training, etc.

- Over the past decade, certain new services based on information and communication technology have become important and essential.

Where are Most People Employed

| Primary Sector |

Secondary Sector |

Tertiary Sector |

| More than half of the workers in India are working in the primary sector, mainly in agriculture. |

These sectors employ less than half the people as compared to the primary sector. |

| It contributes to only a quarter of the GDP. |

These sectors produce four-fifths of the product. |

How to Create More Employment

Employment can be given to people by identifying, promoting and locating industries and services in semi-rural areas. Every state or region has the potential for increasing the income and employment for people in that area. It can be done by tourism, or regional craft industry, or new services like IT. A study conducted by the Planning Commission (known as NITI Aayog) estimates that nearly 20 lakh jobs can be created in the education sector alone.

The central government in India made a law implementing the Right to Work in about 625 districts of India, which is called Mahatma Gandhi National Rural Employment Guarantee Act (MGNREGA) 2005. Under MGNREGA 2005, all those who are able to, and are in need of work in rural areas are guaranteed 100 days of employment in a year by the government. If the government fails in its duty to provide employment, it will give unemployment allowances to the people.

Division of Sectors As Organised and Unorganised

| Organised Sector |

Unorganised Sector |

| It is a sector where the employment terms are fixed and regular, and the employees get assured work. |

The unorganised sector is characterised by small and scattered units, which are largely outside the control of the government. |

| They are registered by the government and have to follow its rules and regulations, which are given in various laws such as the Factories Act, Minimum Wages Act, Payment of Gratuity Act, Shops and Establishments Act, etc. |

There are rules and regulations but these are not followed since they are not registered with the government. |

| The job is regular and has fixed working hours. If people work more, they get paid for the overtime by the employer. |

Jobs are low-paid and often not regular. |

| Workers enjoy the security of employment. |

Employment is not secure. People can be asked to leave without any reason. |

| People working in the organised sector get several other benefits from the employers such as paid leave, payment during holidays, provident fund, gratuity, etc. |

There is no provision for overtime, paid leave, holidays, leave due to sickness, etc. |

| People get medical benefits. The factory manager has to ensure facilities like drinking water and a safe working environment. When they retire, these workers get pensions as well. |

There are no such facilities in the unorganised sector. |

| Examples of the organised sectors are Government employees, registered industrial workers, Anganwadi workers, village health workers, etc. |

Examples of the unorganised sectors are Shopkeeping, Farming, Domestic works, Labouring, Rickshaw pulling, etc. |

How to Protect Workers in Unorganised Sector

There is a need for protection and support of the workers in the unorganised sector. Here are a few points which will help in doing so.

- The government can fix the minimum wages rate and working hours.

- The government can provide cheap loans to self-employed people.

- Government can provide cheap and affordable basic services like education, health, food to these workers.

- The government can frame new laws which can provide provision for overtime, paid leave, leave due to sickness, etc.

Sectors in Term of Ownership: Public and Private Sectors

| Public Sector |

Private Sector |

| In the public sector, the government owns most of the assets and provides all the services. |

In the private sector, ownership of assets and delivery of services is in the hands of private individuals or companies. |

| Railways or post office is an example of the public sector. |

Companies like Tata Iron and Steel Company Limited (TISCO) or Reliance Industries Limited (RIL) are privately owned companies. |

| The purpose of the public sector is not just to earn profits. Its main aim is public welfare. |

Activities in the private sector are guided by the motive to earn profits. |

Responsibilities of Government

There are a large number of activities which are the primary responsibility of the government. Here, we have listed a few of them:

- Government raises money through taxes and other ways to meet expenses on the services rendered by it.

- Governments have to undertake heavy spending such as the construction of roads, bridges, railways, harbours, generating electricity, providing irrigation through dams, etc. Also, it has to ensure that these facilities are available for everyone.

- There are some activities, which the government has to support to encourage the private sector to continue their production or business.

- The government in India buys wheat and rice from farmers at a ‘fair price’ and sells at a lower price to consumers through ration shops. In this way, it supports both farmers and consumers.

- Running proper schools and providing quality education, health and education facilities for all are some of the duties of the government.

- Government also needs to pay attention to aspects of human development such as availability of safe drinking water, housing facilities for the poor and food and nutrition, taking care of the poorest and most ignored regions of the country.

Q3

What is ‘GDP’?

Gross domestic product (GDP) is a measurement that seeks to capture a country’s economic output.

Money as a Medium of Exchange

Money acts as an intermediate in the exchange process, it is called a medium of exchange. A person holding money can easily exchange it for any commodity or service that he or she might want.

Modern form of Money

In the early ages, Indians used grains and cattle as money. Thereafter came the use of metallic coins – gold, silver, copper coins – a phase which continued well into the last century. Now, the modern forms of money include currency – paper notes and coins. The modern forms of money – currency and deposits – are closely linked to the workings of the modern banking system.

Currency

In India, the Reserve Bank of India issues currency notes on behalf of the central government. No other individual or organisation is allowed to issue currency. The rupee is widely accepted as a medium of exchange in India.

Deposits in Banks

The other form in which people hold money is as deposits with banks. People deposit their extra cash with the banks by opening a bank account in their name. Banks accept the deposits and also pay an amount as interest on the deposits.

The deposits in the bank accounts can be withdrawn on demand, these deposits are called demand deposits. The payments are made by cheques instead of cash.

A cheque is a paper instructing the bank to pay a specific amount from the person’s account to the person in whose name the cheque has been issued.

Loan Activities of Banks

Banks keep only a small proportion of their deposits as cash with themselves. These days banks in India hold about 15% of their deposits as cash. This is kept as a provision to pay the depositors who might come to withdraw money from the bank on any given day. Banks use the major portion of the deposits to extend loans. There is a huge demand for loans for various economic activities. Banks charge a higher interest rate on loans than what they offer on deposits. The difference between what is charged from borrowers and what is paid to depositors is their main source of income for banks.

Two Different Credit Situations

Credit (loan) refers to an agreement in which the lender supplies the borrower with money, goods or services in return for the promise of future payment.

Here are 2 examples which help you to understand how credit works.

Festive Season:

In this case, Salim obtains credit to meet the working capital needs of production. The credit helps him to meet the ongoing expenses of production, complete production on time, and thereby increase his earnings. In this situation, credit helps to increase earnings and therefore the person is better off than before.

Swapna’s Problem:

In Swapna’s case, the failure of the crop made loan repayment impossible. She had to sell part of the land to repay the loan. Credit, instead of helping Swapna improve her earnings, left her worse off. This is an example of debt-trap. Credit, in this case, pushes the borrower into a situation from which recovery is very painful. Whether credit would be useful or not, depends on the risks in the situation and whether there is some support, in case of loss.

Terms of Credit

Every loan agreement specifies an interest rate which the borrower must pay to the lender along with the repayment of the principal. In addition, lenders also demand collateral (security) against loans.

Collateral (Security) is an asset that the borrower owns (such as land, building, vehicle, livestocks, deposits with banks) and uses this as a guarantee to a lender until the loan is repaid. If the borrower fails to repay the loan, the lender has the right to sell the asset or collateral to obtain payment.

Interest rate, collateral and documentation requirement and the mode of repayment, together is called the terms of credit. It may vary depending on the nature of the lender and the borrower.

Formal Sector Credit in India

Cheap and affordable credit is crucial for the country’s development. The various types of loans can be grouped as:

Formal sector loans:

These are the loans from banks and cooperatives. The Reserve Bank of India supervises the functioning of formal sources of loans. Banks have to submit information to the RBI on how much they are lending, to whom, at what interest rate, etc.

Informal sector loans:

These are the loans from moneylenders, traders, employers, relatives and friends, etc. There is no organisation which supervises the credit activities of lenders in the informal sector. There is no one to stop them from using unfair means to get their money back.

Formal and Informal Credit

The formal sector meets only about half of the total credit needs of rural people. The remaining credit needs are met from informal sources. It is important that the formal credit is distributed more equally so that the poor can benefit from the cheaper loans.

- It is necessary that banks and cooperatives increase their lending, particularly in rural areas, so that the dependence on informal sources of credit reduces.

- While the formal sector loans need to expand, it is also necessary that everyone receives these loans.

Self Help Groups for the Poor

Poor households are still dependent on informal sources of credit because of the following reasons:

- Banks are not present everywhere in rural India.

- Even if banks are present, getting a loan from a bank is much more difficult as it requires proper documents and collateral.

To overcome these problems, people created Self Help Groups (SHGs). SHGs are small groups of poor people which promote small savings among their members. A typical SHG has 15-20 members, usually belonging to one neighbourhood, who meet and save regularly.

Advantages of Self Help Group (SHG)

- It helps borrowers to overcome the problem of lack of collateral.

- People can get timely loans for a variety of purposes and at a reasonable interest rate.

- SHGs are the building blocks of organisation of the rural poor.

- It helps women to become financially self-reliant.

- The regular meetings of the group provide a platform to discuss and act on a variety of social issues such as health, nutrition, domestic violence, etc.

Frequently Asked Questions on CBSE Class 10 Economics Chapter 3: Money and Credit

Q1

How many currencies are there in the world?

A total of 180 currencies are recognised by the United Nations.

Q2

What of Self help Groups?

1. Women can be financially independent 2. Can borrow loans without collateral 3. Loans are provided are a low interest rate 4. Helps the rural and needy people

Q3

What is ‘collateral’?

Any property or valuable item which is accepted by the lender and is accepted as a security for a loan.

In a matter of years, our markets have transformed.

Production Across Countries

Trade was the main channel connecting distant countries. Large companies, which are now called Multinational Corporations (MNCs) play a major role in trade. An MNC is a company that owns or controls production in more than one nation. MNCs set up offices and factories for production in regions where they can get cheap labour and other resources so that the company can earn greater profits.

Interlinking Production Across Countries

The money that is spent to buy assets such as land, building, machines and other equipment is called investment. An investment made by MNCs is called foreign investment. MNCs are exerting a strong influence on production at these distant locations. As a result, production in these widely dispersed locations is getting interlinked.

There are a variety of ways as mentioned below, in which MNCs are spreading their production and interacting with local producers in various countries across the globe.

- By setting up partnerships with local companies

- By using the local companies for supplies

- By closely competing with the local companies or buying them up

MNCs set up production jointly with local companies which benefits local companies in the following ways:

- First, MNCs can provide money for additional investments, like buying new machines for faster production.

- Second, MNCs might bring with them the latest technology for production.

Foreign Trade and Integration of Markets

Foreign trade creates an opportunity for the producers to reach beyond the domestic markets. Producers can sell their products not only in markets located within the country but can also compete in markets located in other countries of the world. Similarly, buyers have the options to choose among various goods beyond domestically produced goods. Thus, foreign trade results in connecting the markets or integration of markets in different countries.

What is Globalisation

Globalisation is the process of rapid integration or interconnection of countries. MNCs are playing a major role in the globalisation process.

- More and more goods and services, investments and technology are moving between countries.

- There is one more way in which the countries can be connected. This is through the movement of people between countries.

Factors that have Enabled Globalisation

Technology

Rapid improvement in technology has been one major factor that has stimulated the globalisation process. This has made possible much faster delivery of goods across long distances at lower costs. The developments in information and communication technology have made information instantly accessible.

Liberalisation of Foreign Trade and Foreign Investment Policy

Trade barriers are some restrictions that have been set up by governments. The government can use trade barriers to increase or decrease (regulate) foreign trade and to decide what kinds of goods and how much of each, should come into the country. Tax on imports is an example of trade barrier.

Removing barriers or restrictions set by the government on trade is known as liberalisation. When the government imposes less restrictions than before, it is said to be more liberal.

World Trade Organisation

World Trade Organisation (WTO) is an organisation whose aim is to liberalise international trade. At present, 164 countries of the world are currently members of the WTO. It has established rules for developed countries regarding international trade so that these countries can allow free trade for all.

Impact of Globalisation in India

Globalisation has impacted the lives of people in India in the following manner:

- It has provided greater choices to consumers who now enjoy improved quality of and lower prices on several products.

- It has resulted in higher standards of living.

Globalisation has also created new opportunities for companies providing services, particularly in the IT sector.

The Struggle for a Fair Globalisation

Fair globalisation creates opportunities for all and also ensures that the benefits of globalisation are shared better. The government can play a major role in making this possible.

Some of the steps that the government take are:

- It can ensure that labour laws are properly implemented and the workers get their rights.

- It can support small producers to improve their performance.

- If necessary, the government can use trade and investment barriers.

- It can negotiate at the WTO for ‘fairer rules’.

- It can also align with other developing countries with similar interests to fight against the domination of developed countries in the WTO.

What are the benefits of globalisation?

1. Access to foreign cultures 2. Technological innovation 3. Improved living standards 4. Emergence of new talent 5. Higher standards of living

Q2

What are the main elements of globalisation?

Principle elements of globalisation are: 1. International trade 2. foreign investment 3. capital market flows 4. labor migration 5. diffusion of technology

Q3

What are the different types of globalisation?

Political, economic and cultural globalisation are the main types of globalisation.

The Consumer in the Market Place

We participate in the market both as producers and consumers.

- As producers of goods and services, we could be working in any of the sectors such as agriculture, industry or services.

- Consumers participate in the market when they purchase goods and services that they need. These are the final goods that people use as consumers.

The rules and regulations are required for the protection of the consumers in the marketplace.

Consumer Movement

In India, the consumer movement as a ‘social force’ originated with the necessity of protecting and promoting the interests of consumers against unethical and unfair trade practices. Because of all these efforts, a significant initiative was taken in 1986 by the Indian government. It has implemented the Consumer Protection Act 1986, popularly known as COPRA.

Safety is Everyone’s Right

Consumers have the right to be protected against the marketing of goods and delivery of services that are hazardous to life and property. Producers need to strictly follow the required safety rules and regulations.

Information about Goods and Services

When you buy any commodity, you will find certain details given on the packing such as:

- Ingredients used

- Price

- Batch number

- Date of manufacture

- Expiry date

- The address of the manufacturer

This information has been displayed because consumers have the right to get information about the goods and services that they purchase. Consumers can then complain and ask for compensation or replacement if the product proves to be defective in any manner.

In October 2005, the Government of India enacted a law, popularly known as RTI (Right to Information) Act. This law ensures that its citizens get all the information about the functions of government departments.

When Choice is Denied

Any consumer who receives a service in whatever capacity, regardless of age, gender and nature of service, has the right to choose whether to continue to receive the service or not.

Where Should Consumers Go to Get Justice?

Consumers have the right to seek redressal against unfair trade practices and exploitation. The consumer movement in India has led to the formation of various organisations, known as consumer forums or consumer protection councils. They guide consumers on how to file cases in the consumer court.

COPRA, a three-tier quasi judicial machinery at the district, state and national levels was set up for redressal of consumer disputes.

- The district-level court called District Forum, which deals with the cases involving claims up to Rs 20 lakh

- The state level court called State Commission, which deals with the cases involving claims between Rs 20 lakh and Rs 1 crore.

- The national level court is known as the National Commission, which deals with cases involving claims exceeding Rs 1 crore. If a case is dismissed in district-level court, a consumer can also appeal in the state and subsequently in national-level courts.

Learning to Become Well Informed Consumers

The enactment of COPRA has led to the setting up of separate departments of Consumer Affairs in central and state governments. The logo with the letters ISI, Agmark or Hallmark helps consumers to get assurance of quality while purchasing goods and services.

Taking the Consumer Movement Forward

India is one of the countries that has exclusive courts for consumer redressal. 24 December is observed as the National Consumers’ Day in India. After more than 25 years of the enactment of COPRA, consumer awareness is spreading, though slowly in our country. For the speedy process of the consumer movement, we require a voluntary effort and active participation of the people.

Q2

What are the basic rights of consumers?

1. Right to safety.2. Right to choose.3. Right to be informed.4. Right to consumer education.5. Right to be heard.6. Right to Seek redressal.7. Consumer Protection Act.

Q3

What does ‘ISI’ stand for?

The ISI mark is by far the most recognised certification mark in the Indian subcontinent. The name ISI is an abbreviation of Indian Standards Institute, the former name of the Bureau of Indian Standards.